The 3 Parts Every Asset Management Plan Should Have

In an earlier post I wrote about why it’s important, especially in today’s higher-risk development environment, for affordable housing owners to engage in proactive asset management planning. If you’ve decided to make asset management planning a priority—and now you want some tips on exactly what an asset management plan looks like and how to go about creating one—this post is for you.

Envisioning your plan in three parts

Every asset management plan is unique, but most should have three main parts. Here, I’ll explain the purpose of each one and how they all fit together.

Part 1: Policies and portfolio overview

What are your organization’s housing philosophy and goals?

How does your asset management department integrate with fiscal, resident services, and other departments?

What are the job duties of your asset management staff?

What housing properties does your organization own—and what are the characteristics of each property and the residents who live there?

If every member of your asset management team and organizational leadership can answer these (and related) questions with confidence, congratulations: a big part of your asset management planning work is done. If not, taking time to clearly define your housing operation’s high-level asset management goals, policies, and practices will be an important step in your planning process, setting the stage for other planning decisions.

Think of this part of your asset management plan as the written version of the orientation you’d give to a new asset management staff member or to a board member who serves on your housing committee. It gives a broad overview of what asset management looks like at your organization. This section of your plan is foundational and relatively static; you’ll probably want to print it out and update it roughly once a year.

Part 2: Individual property plans

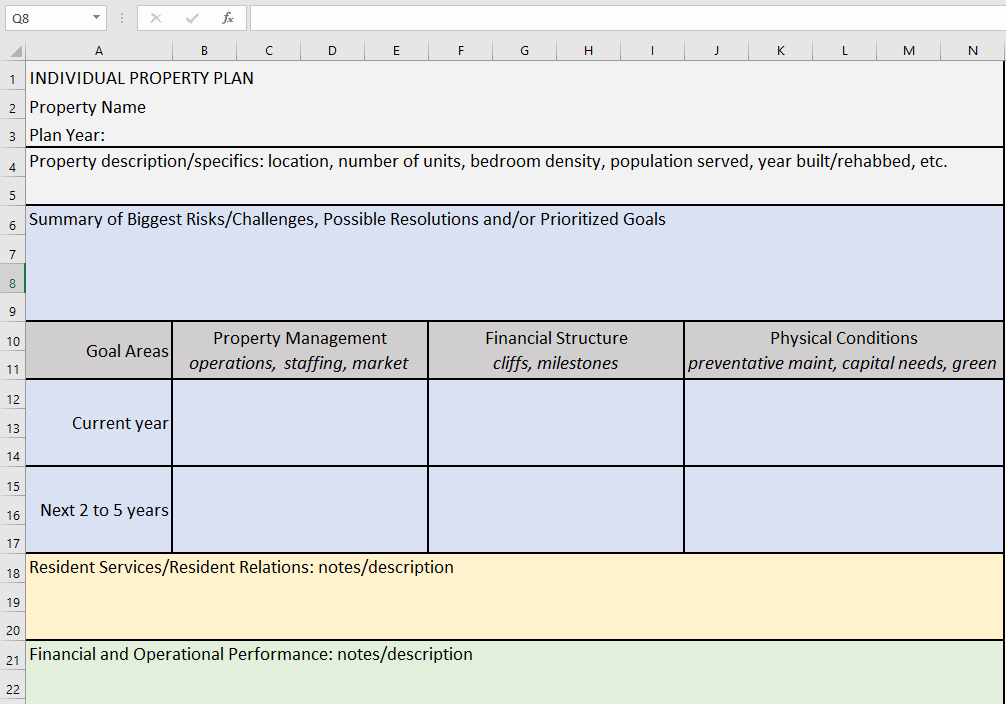

HDC’s individual property plan template contains fields where you can summarize the property’s biggest risks and prioritized goals in areas such as property management, financial structure, and physical conditions.

Unlike Part 1, this part of your asset management plan is dynamic and full of detailed data. It contains a property plan for every property in your portfolio, each composed of several documents (or tools). Together these documents contain property-specific data, as well as property-specific performance goals related to operations, physical property condition, resident services, and other areas subject to asset management oversight. Most are in spreadsheet form, some updated as often as once a month.

Here are examples of documents/tools you’ll want to create or obtain for each property in your portfolio:

A compliance chart (see my earlier post about how and why to create compliance charts).

A financial analysis tool, with indicators chosen for the property based on its specific performance goals and risk areas.

A capital needs assessment and/or other record of the property’s physical condition.

These individual property plans will provide all the data and analysis you’ll need to understand each property’s performance on a month-to-month basis, along with defined goals and strategies to guide property-specific asset management decisions. Keep each set of property-specific documents filed in its own library on your server, where it is easy to access and update.

Part 3: The portfolio plan

This is the part of your asset management plan where all the property-specific data and analysis you’ve compiled and prepared is rolled up in summary form. Your portfolio plan will give board members and others involved in property oversight the information they need to understand your housing operation’s performance and goals on a high-level, portfolio-wide basis. It should contain a minimum of three documents:

A major-milestone chart that lists expected dates of Year 15 exits, refinances, and other major milestones across your portfolio.

A dashboard that shows how the portfolio is performing according to metrics that are relevant to the owner, investors, and funders.

A portfolio action plan that summarizes portfolio goals and the main portfolio activities that will take place in the current year, based on individual property plans and the major-milestone chart.

Building the plan: advice to get started

Knowing what an asset management plan looks like is different from building one. HDC’s Building Asset Management Solutions (BAMS) curriculum is designed to help organizations navigate this process, and HDC provides the same type of support and guidance to organizations on a one-on-one basis. I can’t give you step-by-step instructions for designing your unique planning process, but I can offer one general insight to help you get started: asset management planning is collaborative and iterative.

In most cases, responsibility for drafting the plan will fall to one or more members of your asset management/housing team, while your executive director and board leadership will provide guidance and input. Regardless of how the process is organized and roles are assigned, your plan will have the most impact if all parties who influence asset management decision-making participate. (This is the collaborative part.)

Your planning team should expect and embrace a process that may feel messy at first. Asset management staff and board members will come to the work with different knowledge and perspectives, and creating shared understanding will take time. Questions may arise that require additional research, or input from additional parties, to resolve. As data gaps are filled in, assumptions are refined, and deeper questions are explored, each part of the plan will flesh out and evolve. (This is the iterative part.)

Whatever route you take through the planning process, the important thing is to get started and keep your eye on the end goal. Remember, the purpose of creating an asset management plan is to empower all levels of staff and leadership in your organization to review the performance of your housing properties against your organization’s housing mission and goals—using accurate information to guide intelligent, strategic decisions. By setting an intention to create an asset management plan, you’ll be moving toward a reality where your properties are in the best possible position to provide affordable homes to low-income residents far into the future. And that inspiring outcome is, after all, what affordable housing asset management is all about.

Kimberly Taylor is HDC’s Director of Asset Management. You can find her full bio and contact information here.